pay utah corporate tax online

Utah has a flat corporate income tax rate of 5000 of gross income. Sign In to Pay and See Your Payment History For individuals only.

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

You will need your property serial number s.

. Online payments may include a service fee. You can also pay online and avoid the hassles of mailing in a. Pay Real Property Tax Pay Business.

Make a same day payment from your bank account for your balance payment plan estimated tax or other types of payments. Click the link above to be directed to TAP Utahs Taxpayer Access Point DO NOT LOGIN OR CREATE A LOGIN Go to Payments and select either Make e-Check Payment or. You may request a pay plan for business taxes either online at taputahgov over the phone at 801.

Establish your Utah businesss corporate income tax obligations Your business entity type will determine how your Utah small business is taxed. For security reasons our e-services TAP OSBR etc are not available. This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file.

Go to Taxpayer Access Point and create a TAP login to file and pay your Utah business taxes. LLCs operating in Utah that elect for taxation as. The federal corporate income tax by contrast has a marginal bracketed corporate income taxUtahs maximum.

The corporate income tax in Utah is generally a flat rate of 5 percent of the taxable income of the business. Payment Types Accepted Online. Salt Lake City Utah 84114-1001.

Your accounting period is usually your financial year but. Follow the instructions at taputahgov. Office of State Debt Collection.

Go to Your Account Pay from Your Bank Account. If you do not have these please request a duplicate tax notice here. Mail Payment and Correspondence.

A corporation that had a tax liability of 100 the minimum tax for the previous. Taxable profits of up to 15 million. The minimum tax if 100.

Corporation income is taxed at a flat. Pay by Mail You may also mail your check or money order payable to the Utah State Tax Commission with. You must pay your Corporation Tax 9 months and 1 day after the end of your accounting period.

This web site allows you to pay your Utah County real and business personal property taxes online using credit cards debit cards or electronic checks. View the amount you owe your payment plan details payment history and any scheduled or pending payments.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

![]()

Utah Income Taxes Utah State Tax Commission

Utah Sales Use Tax Registration Service Harbor Compliance

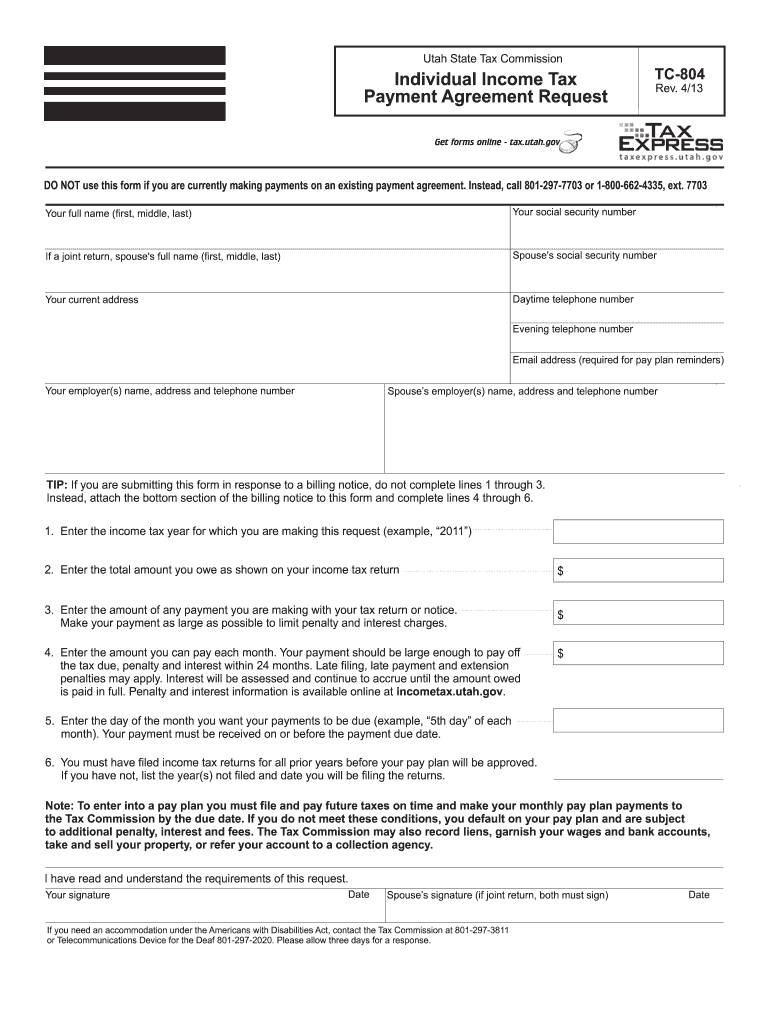

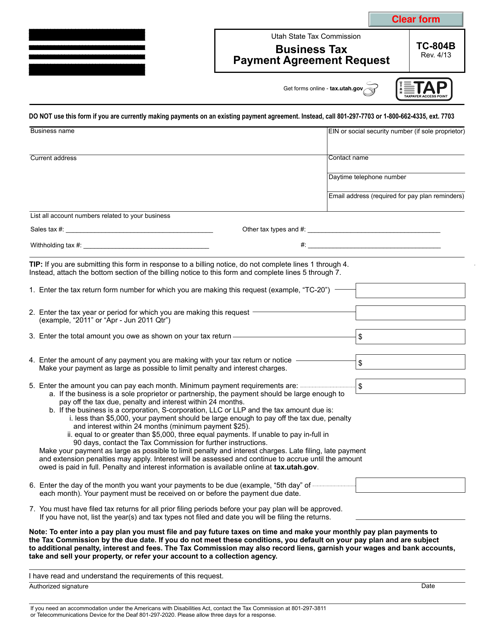

Ut Tc 804 2013 Fill Out Tax Template Online Us Legal Forms

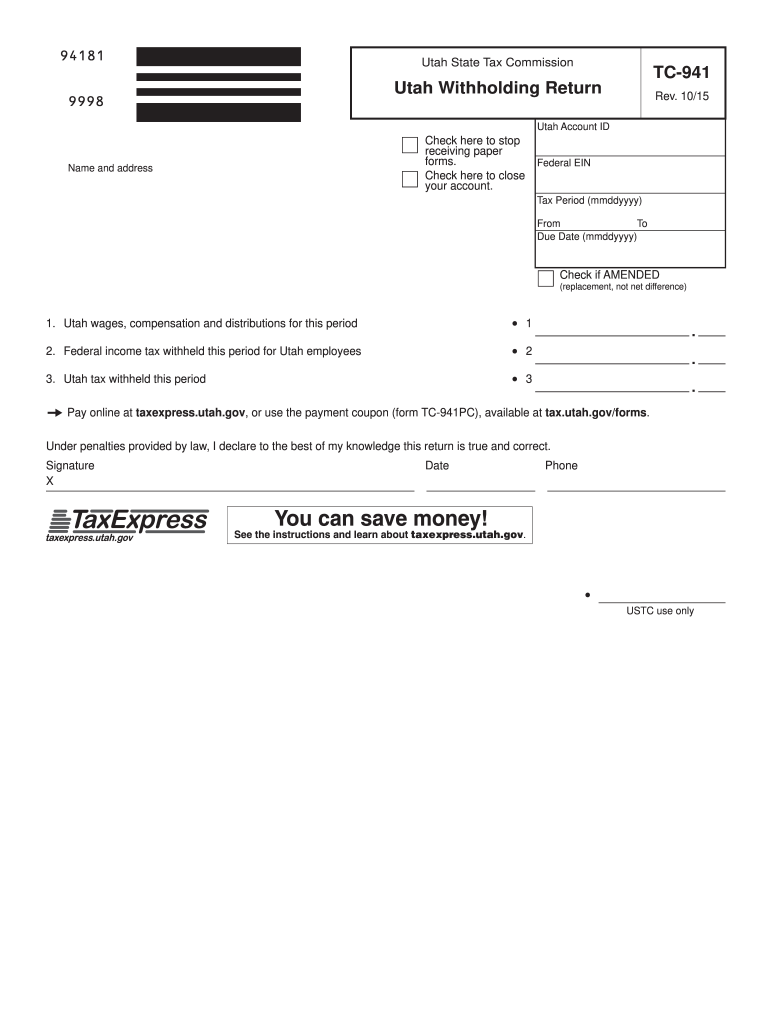

Tc 941e Fill Out Sign Online Dochub

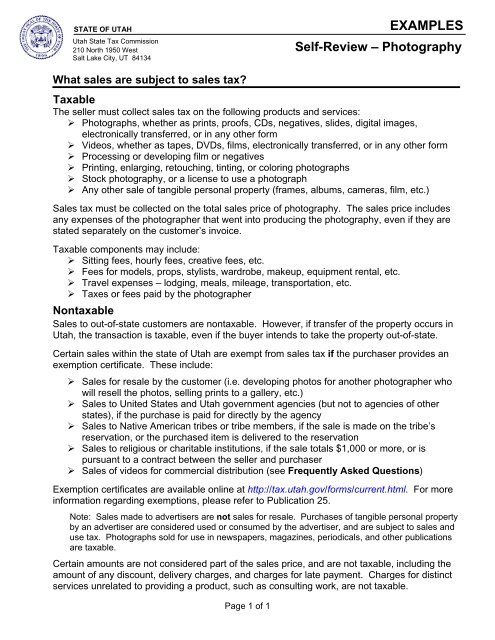

Examples Self Review Photography Utah State Tax

Utah Sales Tax Guide And Calculator 2022 Taxjar

Tc 69 Utah Form Fill Out Sign Online Dochub

Utah State Tax Commission Notice Of Change Sample 1

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Ut Ustc Tc 938 2019 2022 Fill Out Tax Template Online Us Legal Forms

New Laws In 2019 Include Online Sales Tax For Out Of State Purchases

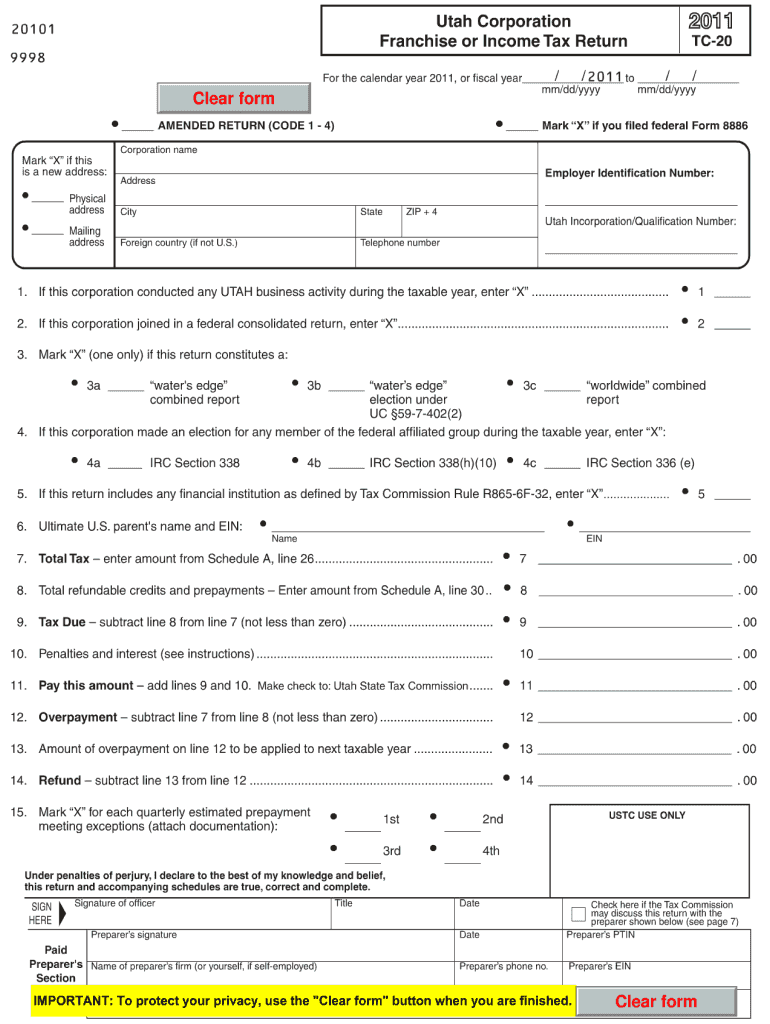

2011 Form Ut Ustc Tc 20 Fill Online Printable Fillable Blank Pdffiller

Form Tc 804b Download Fillable Pdf Or Fill Online Business Tax Payment Agreement Request Utah Templateroller

The Supreme Court Cleared The Way For Utah To Collect Sales Taxes From All Online Sales Here S What It Means For Consumers And Businesses

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

Here Are The Corporate Tax Rate Bills You Should Pay Attention To This Year Multistate