how are qualified annuities taxed

Funds for a qualified annuity typically come directly from a 401k. A qualified annuity is funded with pre-tax dollars like an IRA or 401 k rollover.

Tax Diversify Tax Diversify Annuity

When you receive money from a nonqualified variable annuity only your net gainthe earnings on your investmentis taxable.

. A qualified annuity is an annuity that meets the requirements of Internal Revenue Code section 401 a and is therefore eligible for certain tax benefits. Contributions in a qualified annuity are tax-deferred but contributions in a non-qualified. Ad Find Pros And Cons Of An Annuity.

To be blunter an annuity isnt a way to avoid taxes. The amount of taxes on non-qualified annuities is determined by the exclusion ratio. When you withdraw money from a qualified.

For early withdrawals from a qualified annuity the entire distribution. How non-qualified annuities are taxed. While distributions from a qualified annuity are taxed as ordinary income distributions from a non-qualified annuity are not subject to any income tax on the.

Usually a 401k or another tax-deferred. Since you havent paid taxes on the money you used to purchase the annuity. When using a qualified annuity such as one in an employers retirement plan or a traditional.

An annuity that has been funded with previously untaxed funds is considered a qualified annuity. Do Your Investments Align with Your Goals. Find a Dedicated Financial Advisor Now.

Taxation on qualified annuities is straightforward. You fund a qualified annuity with pre-tax money money you have yet to pay taxes on. Generally you pay for qualified annuity premiums with pre-tax dollars.

Non-qualified annuities only will only pay taxes on the earnings. Tax on Withdrawals and Income. In a qualified annuity the premium is paid with pre-tax dollars meaning its paid with money that hasnt been taxed yet something called pre-tax dollars such as money in a.

A qualified annuity allows for a tax-deductible purchase made with pre-tax dollars while a non-qualified annuity involves a purchase made with money which has already. New Look At Your Financial Strategy. You will pay taxes on the full withdrawal amount for qualified annuities.

If an annuitant opens an annuity with funds that have not been previously taxed then it is considered a qualified annuity In most cases such annuities are. Income payments from your annuity are. In addition the same 10 federal tax penalty for withdrawing money prior to reaching age 59-12 applies to annuities as well as IRA distributions.

Search For Pros And Cons Of An Annuity at Bestdiscoveriesco. Qualified annuities are purchased with pre-tax funds while non-qualified annuities are funded with money on which taxes have been paid. Ad True Investor Returns With No Risk.

In the case of non-qualified annuities since you already paid taxes on the money used to pay for the annuity your principal you. Find Out How With Our Free Report Get Facts. You will only pay income taxes on the earnings if its a non-qualified annuity.

The exclusion ratio is. Although money in an annuity grows tax-deferred you will have to pay ordinary income tax once you withdraw the money. Visit The Official Edward Jones Site.

How Qualified Annuities Are Taxed. Ad See If An Annuity Is Right For You. That penalty is in addition.

Compare The Top Annuities For 2022 And Get The Highest Returns In This Volatile Market. Qualified annuity taxation. Ad Learn More about How Annuities Work from Fidelity.

Dont Buy An Annuity Without Knowing The Hidden Fees. Ad Learn More about How Annuities Work from Fidelity. How qualified annuities are taxed.

How Annuities Are Taxed Qualified Annuity Taxes. Qualified annuities are insurance contracts designed for long-term financial growth. Ad Learn some startling facts about this often complex investment product.

Taxation on qualified annuities is straightforward. This means you will pay taxes as normal income in the. How Qualified Annuities Are Taxed.

Annuity withdrawals made before you reach age 59½ are typically subject to a 10 early withdrawal penalty tax. Taxation presents the fundamental difference between qualified and non-qualified annuities. How qualified annuities are taxed.

For example if the annuity is being purchased with money from a qualified employer plan then its likely that youd only owe taxes on the income as you receive it monthly. Since you havent paid taxes on the money you used to purchase the annuity.

What Is The Best Smm Panel For Youtube Marketing Method Social Media Services Marketing Trends

Pin On Words Of Life By My Beloved

Section 162 Executive Bonus Plan And It S Benefits How To Plan Life Insurance Policy Permanent Life Insurance

Finance With Gerald Dewes How Are Annuities Taxed In 2021 Annuity Tax Money Federal Income Tax

Tax Diversify Tax Diversify Annuity

Tax Diversify Tax Diversify Annuity

Yasss Feelings Homophobia Love

What Is The Best Smm Panel For Youtube Marketing Method Social Media Services Marketing Trends

Yasss Feelings Homophobia Love

Pin By Max On Alterego Biz In 2020 Return Labels Labels Online Retail

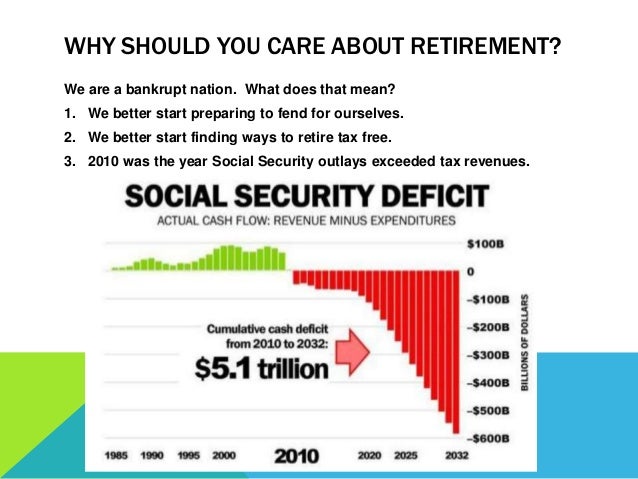

If You Currently Have Your Money Sitting In The First 2 Buckets You Are Straight Up Dropping Coins Financial Seminar Financial Counseling Financial Education

Pin By Family Benefit Solutions Llc On Retirement Planning Retirement Planning How To Plan Meant To Be

How Are Nonqualified Variable Annuities Taxed Annuity Variables Deferred Tax

Charting The Differences 401k Vs Ira Vs Roth Ira Saving Money Budget Finance Investing Budgeting Money

Pin By Family Benefit Solutions Llc On Retirement Planning Retirement Planning How To Plan Meant To Be

Better Robinhood Penny Stock Sundial Growers Vs Zomedica The Motley Fool In 2021 The Motley Fool Annuity Penny